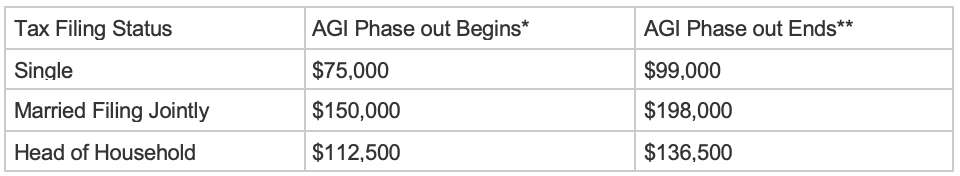

| On March 27, 2020, President Trump signed the CARES Act — a massive $2 trillion dollar stimulus program meant to help businesses and individuals mitigate the financial loss they might be experiencing during the coronavirus pandemic. Today, we are going to take a high level look at the CARES Act and let you know who is impacted, and how. The details of some of these provisions, specifically for small business owners have been discussed in detail on other blog posts, and we will continue to release information as things change. Today we will look specifically at how individuals and families benefit. Tomorrow we will look at business owners specifically. How individuals benefit: Stimulus checks Perhaps one of the most well-known aspects of this bill is a stimulus check sent to every individual in the amount of $1,200 / adult and $500 / child under 17. There are income restrictions and a phaseout schedule as listed below. But the vast majority of Americans will receive at least some stimulus money in the form of a check or direct deposit (however you received your tax refund the last time you filed). |

| * Stimulus checks will be reduced by $5 for every additional $100 of income above this amount up to the amount at which the income phase out ends.** Taxpayers who earn this amount or more generally won’t receive a stimulus check unless they have children; having children raises the AGI phase out limit. Federal Unemployment For those who have become unemployed during this pandemic, the CARES Act has really eased restrictions on filing for unemployment and allows most everyone who was laid off or unable to work because of COVID-19 the opportunity to receive $600 / week over the next 4 months. There are restrictions and not everyone will qualify, but it has been extended to self-employed and contract workers as well. To apply, you will need to go through your state’s unemployment website. No RMDs! If you are at retirement age you were probably expecting to have to take a minimum distribution out of your IRA, 401(k) or 403(b) like every other year. That would have been a hit for many retirees who have likely already seen their retirement account take a significant dip this year because of the sudden drop in the financial markets. The good news is, the government is removing that mandate for 2020 which is a huge benefit for retirees. Talk to your financial advisor about how this affects your financial plan. Tax deadline postponed Procrastinators rejoice! That April 15 tax day has become a July 15 tax day. Both the filing date, along with any interest or penalties have been suspended to July 15 as well. No penalty for early withdrawal from retirement accounts. In a normal world the government imposes a 10% penalty on any withdrawals from retirement accounts such as IRAs, 401(k)s or 403(b)s if you withdraw before age 59 and 1/2. Knowing you might need access to that cash right now, they’ve done away with that penalty for now. You will, however, probably need to pay income taxes on those withdrawals since they are likely pretax dollars you are withdrawing. Another nice bonus is that you can pay all those funds back to your retirement accounts over the next 3 years without running into contribution caps up to whatever you took out. Note: This benefit is capped at $100,000. Paid sick leave For COVID-19 related reasons, employees receive up to 80 hours of paid sick leave and expanded paid childcare leave when employees’ children’s’ schools are closed or childcare providers are unavailable. Real ID extension You know that TSA agent that has been reminding you every time you travel to update your driver’s license by October 1, 2020? Well, that has been extended to October 1, 2021. Again, procrastinators rejoice! This article is meant for information purposes only and is not considered a recommendation for your personal financial plan. If you have questions on how the CARES Act impacts you, please contact your financial advisor. |

You must be logged in to leave a reply.