By Jason T. Schneider, CPA, CGMA

Posted March 28, 2020

We understand that there is a lot going through your mind as a business owner during this time. Please know that we are here to provide support and guidance as much as we can to help navigate you through the turbulence.

As you might have imagined, we’ve have been receiving a multitude of questions largely stemming from media reports about what you can do as an employee and/or business owner. Because every case is unique and requires its own level of scrutiny, we hope that this gives you the information necessary to make informed decisions that will best suit your needs.

It is important to note that the information being provided is generally changing by the hour and actual IRS forms are not yet available. Clarification on many of the laws and credits below remains to be provided.

Here are the items we will address in the post:

- Families First Coronavirus Response Act (FFCRA)

- Coronavirus Aid, Relief, and Economic Security

Act (CARES)

- Summary of Individual Tax Provisions

- Stimulus Payments

- Summary of Business Tax Provisions

- Paycheck Protection Program

- Summary of Individual Tax Provisions

- SBA Disaster Loans

Families First Coronavirus Response Act (FFCRA)

Filing and payment deadlines deferred. After briefly offering more limited relief, the IRS almost immediately pivoted to a policy that provides the following to all taxpayers-meaning all individuals, trusts, estates, partnerships, associations, companies or corporations, regardless of whether or how much they are affected by COVID-19:

- For a taxpayer with a Federal income tax return or a Federal income tax payment due on April 15, 2020, the due date for filing and paying has automatically been postponed to July 15, 2020, regardless of the size of the payment owed.

- The taxpayer does not have to file Form 4686 (automatic extensions for individuals) or Form 7004 (certain other automatic extensions) to get the extension.

- The relief is for (A) Federal income tax payments (including tax payments on self-employment income) and Federal income tax returns due on April 15, 2020 for the person’s 2019 tax year, and (B) Federal estimated income tax payments (including tax payments on self-employment income) due on April 15, 2020 for the person’s 2020 tax year.

- No extension is provided for the payment or deposit of any other type of Federal tax (e.g. estate or gift taxes) or the filing of any Federal information return.

- As a result of the return filing and tax payment postponement from April 15, 2020, to July 15, 2020, that period is disregarded in the calculation of any interest, penalty, or addition to tax for failure to file the postponed income tax returns or pay the postponed income taxes. Interest, penalties and additions to tax will begin to accrue again on July 16, 2020.

Favorable treatment for COVID-19 payments from Health Savings Accounts. Health savings accounts (HSAs) have both advantages and disadvantages relative to Flexible Spending Accounts when paying for health expenses with untaxed dollars. One disadvantage is that a qualifying HSA may not reimburse an account beneficiary for medical expenses until those expenses exceed the required deductible levels. However, IRS has announced that payments from an HSA that are made to test for or treat COVID-19 do not affect the status of the account as an HSA (and do not cause a tax for the account holder) even if the HSA deductible has not been met. Vaccinations continue to be treated as preventative measures that can be paid for without regard to the deductible amount.

Tax credits and a tax exemption to lessen burden of COVID-19 business mandates. On March 18, President Trump signed into law the Families First Coronavirus Response Act (the Act, PL 116-127), which eased the compliance burden on businesses. The Act includes the four tax credits and one tax exemption discussed below.

Paid Sick Leave for Workers:

For COVID-19 related reasons, employees receive up to 80 hours of paid sick leave and expanded paid childcare leave when employees’ children’s’ schools are closed or childcare providers are unavailable.

Complete Coverage:

Employers receive 100% reimbursement for paid leave pursuant to the Act.

· Health insurance costs are also included in the credit.

· Employers face no payroll tax liability.

· Self-employed individuals receive an equivalent credit.

Small Business Exemption (as referenced by the IRS)

Small businesses with fewer than 50 employees will be eligible for an exemption from the leave requirements relating to school closings or childcare unavailability where the requirements would jeopardize the ability of the business to continue. The exemption will be available on the basis of simple and clear criteria that make it available in circumstances involving jeopardy to the viability of an employer’s business as a going concern. Labor will provide emergency guidance and rulemaking to clearly articulate this standard.

Payroll tax credit for required paid sick leave (the payroll sick leave credit).

The Emergency Paid Sick Leave Act (EPSLA) division of the Act generally requires private employers with fewer than 500 employees to provide 80 hours of paid sick time to employees who are unable to work for virus-related reasons (with an administrative exemption for less-than-50-employee businesses that the leave mandate puts in jeopardy). The pay is up to $511 per day with a $5,110 overall limit for an employee directly affected by the virus and up to $200 per day with a $2,000 overall limit for an employee that is a caregiver.

The tax credit corresponding with the EPSLA mandate is a credit against the employer’s 6.2% portion of the Social Security (OASDI) payroll tax (or against the Railroad Retirement tax). The credit amount generally tracks the $511/$5,110 and $200/$2,000 per-employee limits described above. The credit can be increased by (1) the amount of certain expenses in connection with a qualified health plan if the expenses are excludible from employee income and (2) the employer’s share of the payroll Medicare hospital tax imposed on any payments required under the EPSLA. Credit amounts earned in excess of the employer’s 6.2% Social Security (OASDI) tax (or in excess of the Railroad Retirement tax) are refundable. The credit is electable and includes provisions that prevent double tax benefits (for example, using the same wages to get the benefit of the credit and of the current law employer credit for paid family and medical leave). The credit applies to wages paid in a period (1) beginning on a date determined by IRS that is no later than April 2, 2020 and (2) ending on December 31, 2020.

Income tax sick leave credit for the self-employed (self-employed sick leave credit).

The Act provides a refundable income tax credit (including against the taxes on self-employment income and net investment income) for sick leave to a self-employed person by treating the self-employed person both as an employer and an employee for credit purposes. Thus, with some limits, the self-employed person is eligible for a sick leave credit to the extent that an employer would earn the payroll sick leave credit if the self-employed person were an employee.

Accordingly, the self-employed person can receive an income tax credit with a maximum value of $5,110 or $2,000 per the payroll sick leave credit. However, those amounts are decreased to the extent that the self-employed person has insufficient self-employment income determined under a formula or to the extent that the self-employed person has received paid sick leave from an employer under the Act. The credit applies to a period (1) beginning on a date determined by the IRS that is no later than April 2, 2020 and (2) ending on December 31, 2020.

Payroll tax credit for required paid family leave (the payroll family leave credit).

The Emergency Family and Medical Leave Expansion Act (EFMLEA) division of the Act requires employers with fewer than 500 employees to provide both paid and unpaid leave (with an administrative exemption for less-than-50-employee businesses that the leave mandate puts in jeopardy). The leave generally is available when an employee must take off to care for the employee’s child under age 18 because of a COVID-19 emergency declared by a federal, state, or local authority that either (1) closes a school or childcare place or (2) makes a childcare provider unavailable. Generally, the first 10 days of leave can be unpaid and then paid leave is required, pegged to the employee’s pay rate and pay hours. However, the paid leave can’t exceed $200 per day and $10,000 in the aggregate per employee.

The tax credit corresponding with the EFMLEA mandate is a credit against the employer’s 6.2% portion of the Social Security (OASDI) payroll tax (or against the Railroad Retirement tax). The credit generally tracks the $200/$10,000 per employee limits described above. The other important rules for the credit, including its effective period, are the same as those described above for the payroll sick leave credit.

Income tax family leave credit for the self-employed (self-employed family leave credit).

The Act provides to the self-employed a refundable income tax credit (including against the taxes on self-employment income and net investment income) for family leave similar to the self-employed sick leave credit discussed above. Thus, a self-employed person is treated as both an employer and an employee for purposes of the credit and is eligible for the credit to the extent that an employer would earn the payroll family leave credit if the self-employed person were an employee.

Accordingly, the self-employed person can receive an income tax credit with a maximum value of $10,000 as per the payroll family leave credit. However, under rules similar to those for the self-employed sick leave credit, that amount is decreased to the extent that the self-employed person has insufficient self-employment income determined under a formula or to the extent that the self-employed person has received paid family leave from an employer under the Act. The credit applies to a period (1) beginning on a date determined by IRS that is no later than April 2, 2020 and (2) ending on December 31, 2020.

Exemption for employer’s portion of any Social Security (OASDI) payroll tax or railroad retirement tax arising from required payments.

Wages paid as required sick leave payments because of EPSLA or as required family leave payments under EFMLEA aren’t considered wages for purposes of the employer’s 6.2% portion of the Social Security (OASDI) payroll tax or for purposes of the Railroad Retirement tax.

Examples (provided by the IRS)

If an eligible employer paid $5,000 in sick leave and is otherwise required to deposit $8,000 in payroll taxes, including taxes withheld from all its employees, the employer could use up to $5,000 of the $8,000 of taxes it was going to deposit for making qualified leave payments. The employer would only be required under the law to deposit the remaining $3,000 on its next regular deposit date.

If an eligible employer paid $10,000 in sick leave and was required to deposit $8,000 in taxes, the employer could use the entire $8,000 of taxes in order to make qualified leave payments and file a request for an accelerated credit for the remaining $2,000.

Equivalent childcare leave and sick

leave credit amounts are available to self-employed individuals under similar

circumstances. These credits will be claimed on their income tax return and

will reduce estimated tax payments.

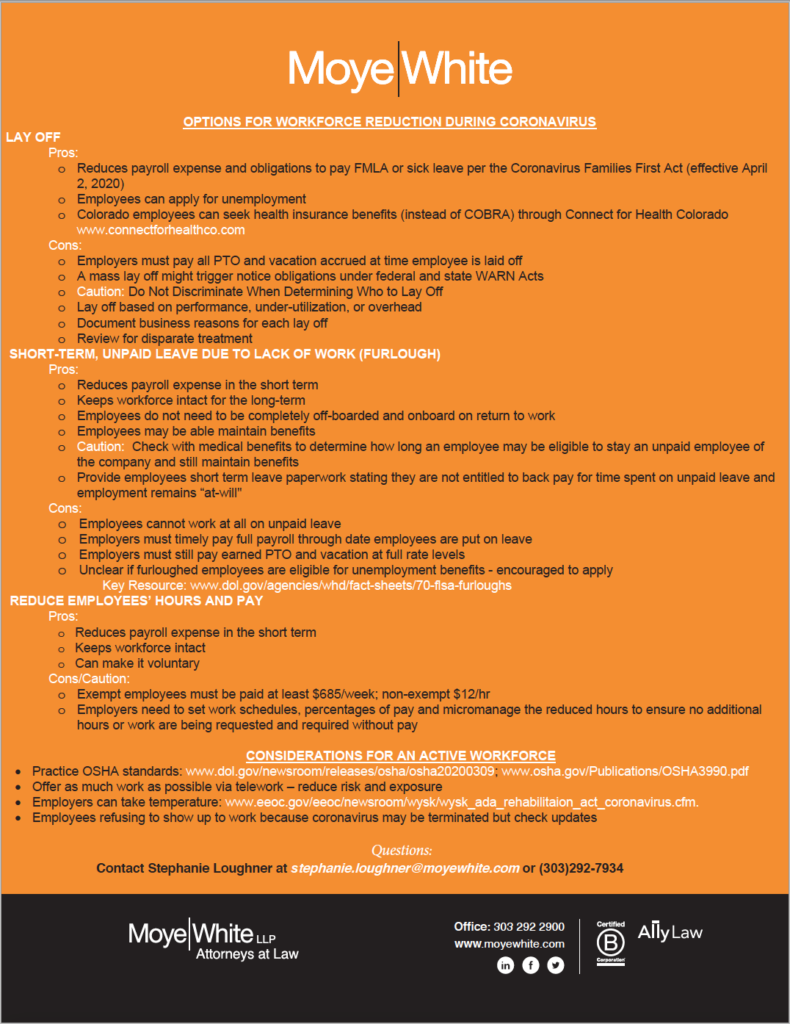

Options for Workforce Reduction During the Coronavirus

Provided by Stephanie D. Laughner – Leader in Moye White’s Employment Group

Phone: 303-292-7934 Email: stephanie.loughner@moyewhite.com

Coronavirus Aid, Relief, and Economic Security Act (CARES)

Summary of Individual Tax Provisions – Provided by the Committee on Finance

Coronavirus Stimulus Payments: When Will They Be Sent and Who is Eligible?

As reported by the Wall Street Journal

The plan provides $1,200 for each adult and $500 for each child under 17. A married couple with two children would get $3,400. The payments go to almost any adult with a Social Security number, as long as they aren’t dependents of someone else. Those adults get the payments for the children in their household.

Payments start phasing out for those with income above $75,000 in adjusted gross income for individuals, $112,500 for heads of household (often single parents) and $150,000 for married couples. The payments start shrinking above those levels.

For those with no children, the benefit disappears at $99,000 for individuals and $198,000 for married couples.

The government will use 2019 tax returns to set the payment amounts and 2018 tax returns if 2019 isn’t available. According to some economists payments will be in May (versus April 6 which is touted by the White House). What is unknown is if you qualify under 2018 but not 2019, do you still receive the payment? Or vise-versa? Or, if you qualify under 2018’s income amounts, receive the payments, file 2019’s tax returns which do not qualify because of income phase-outs, do you have to return the payments?

Other Individual Provisions:

Special Rules for Use of Retirement Funds

Consistent with previous disaster-related relief, the provision waives the 10-percent early withdrawal penalty for distributions up to $100,000 from qualified retirement accounts for coronavirus-related purposes made on or after January 1, 2020. In addition, income attributable to such distributions would be subject to tax over three years, and the taxpayer may recontribute the funds to an eligible retirement plan within three years without regard to that year’s cap on contributions.

Temporary Waiver of RMDs

The provision waives the required minimum distribution rules for certain defined contribution plans and IRAs for calendar year 2020.

Allowance for Partial Above the Line Deduction for Charitable Contributions

The provision encourages Americans to contribute to churches and charitable organizations in 2020 by permitting them to deduct up to $300 of cash contributions, whether they itemize their deductions or not.

Coronavirus Aid, Relief, and Economic Security Act (CARES)

Summary of Business Tax Provisions – Provided by the Committee on Finance

Exclusion for Certain Employer Payments of Student Loans

The provision enables employers to provide a student loan repayment benefit to employees on a tax-free basis. Under the provision, an employer may contribute up to $5,250 annually toward an employee’s student loans, and such payment would be excluded from the employee’s income.

Employee Retention Credit for Employers Subject to Closure Due to COVID-19

The provision provides a refundable payroll tax credit for 50 percent of wages paid by employers to employees during the COVID-19 crisis. The credit is available to employers whose (1) operations were fully or partially suspended, due to a COVID-19-related shut-down order, or (2) gross receipts declined by more than 50 percent when compared to the same quarter in the prior year.

Delay of Payment of Employer Payroll Taxes

The provision allows employers and self-employed individuals to defer payment of the employer share of the Social Security tax they otherwise are responsible for paying to the federal government with respect to their employees. Employers generally are responsible for paying a 6.2-percent Social Security tax on employee wages. The provision requires that the deferred employment tax be paid over the following two years, with half of the amount required to be paid by December 31, 2021 and the other half by December 31, 2022. The Social Security Trust Funds will be held harmless under this provision.

Modifications for Net Operating Losses

The provision relaxes the limitations on a company’s use of losses. Net operating losses (NOL) are currently subject to a taxable-income limitation, and they cannot be carried back to reduce income in a prior tax year. The provision provides that an NOL arising in a tax year beginning in 2018, 2019, or 2020 can be carried back five years. The provision also temporarily removes the taxable income limitation to allow an NOL to fully offset income. These changes will allow companies to utilize losses and amend prior year returns, which will provide critical cash flow and liquidity during the COVID-19 emergency.

Coronavirus Aid, Relief, and Economic Security Act (CARES)

Summary of the Paycheck Protection Program

One of the best parts of the CARES Act is the opportunity for small businesses to take advantage of the Paycheck Protection Program (PPP). This program is aimed at supporting employment and providing relief during this uncertain time. It is important to note that this is not the same program as the Economic Injury Disaster Loan Program (EIDL). While both loans are available they differ significantly and businesses cannot get both the EIDL and PPP loans at the same time.

Key Takeaways of the PPP:

- Waives both borrower and lender fees for participation in the Paycheck Protection Program.

- Waives the credit elsewhere test for funds provided under this program.

- Waives collateral and personal guarantee requirements under this program.

- Includes sole-proprietors, independent contractors, and other self-employed individuals as eligible for loans.

- Allow businesses with more than one physical location and employs no more than 500 employees per physical location in certain industries to be eligible.

- Allowable uses of the loan include payroll support, such as employee salaries, as paid sick or medical leave, insurance premiums, mortgage payments, and any other debt obligations.

Loan Program Summary

Cover Period began on March 1, 2020 and will end on December 31, 2020

Calculation of the loan

The maximum loan size is $10 million. The calculation is as follows:

2.5x the average monthly “payroll” costs, measured over the 12 months preceding the loan origination date. Seasonal business may use the period February 15, 2019 – June 30, 2019 or March 1, 2019 – June 30, 2019 to calculate the average payroll

Payroll includes salaries, commissions, tips, certain employee benefits (including health insurance and retirement benefits), state and local taxes and certain types of compensation to sole proprietors or independent contractors. Payroll costs specifically exclude employees who are compensated at $100,000 or greater, foreign employees, FICA and income tax withholdings.

Allowable Uses of the Program Loan

During the covered period, a recipient of a loan made under section 7(a) of the Small Business Act may, in addition to the allowable uses of such a loan, use the proceeds of the loan for—

(A) payroll support, including paid sick, medical, or family leave, and costs related to the continuation of group health care benefits during those periods of leave;

(B) employee salaries;

(C) mortgage payments;

(D) rent (including rent under a lease agreement);

(E) utilities; and

(F) any other debt obligations that were incurred before the covered period.

Loan Forgiveness

It is my understanding that after you execute the loan the “clock” starts. At this time, you will want to account (in very good detail) the following expenses over the next eight weeks. More information on this below but the specific expenses related to Payroll, Mortgage Interest, Rent and Utilities are the most important as they can be included in the application for loan forgiveness. It is also important to save all documentation pertaining to these expense categories as the bill specifically states it is effective for these expenses if they were incurred or were effective before February 15, 2020. As more clarity on the bill and its intent was provided, this will become clearer if expenses incurred and paid for after February 15, 2020 will also be included in the forgivable portion of the loan.

When submitting the application seeking loan forgiveness you will need to include documentation verifying which shall include documentation verifying the number of full-time equivalent employees on payroll and pay rates for the periods described in subsection (d), including—

(1) payroll tax filings reported to the Internal Revenue Service;

(2) State income, payroll, and unemployment insurance filings;

(3) financial statements verifying payment on debt obligations incurred before the covered period; and

(4) any other documentation the Administrator determines necessary.

Reduction of Loan Forgiveness

Based on the CARES Act, payments can be deferred by up to a year, and businesses will be able to apply for forgiveness of the loan (or a portion of it), based on the amount used during the eight weeks following loan approval. The loan forgiveness amount, which is excluded from taxable income, is equal to the payroll costs, mortgage interest payments, rent, and utility payments incurred or paid by a recipient during the covered period.

The reduction formula consists of comparing an employer’s average number of full-time employees from February 15, 2020, through June 30, 2020, and the employer’s average number of full-time employees from either February 15, 2019, through June 30, 2019, or January 1, 2020, through February 29, 2020.

Note: This information was highly summarized from the actual bill located here.

SBA Disaster Loan Assistance

Economic Injury Disaster Loan Program

Small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to Coronavirus (COVID-19). Click here to apply.

Find more information on the SBA’s Economic Injury Disaster Loans at: SBA.gov/Disaster.

As mentioned above, it is important to note that this is not the same program as the Economic Injury Disaster Loan Program (EIDL). While both loans are available they differ significantly and businesses cannot get both the EIDL and PPP loans at the same time.

We have heard the SBA site is really slow and is often down for online submission due to the sheer volume of applications being received. As such individuals can fax their application and supporting documents. Fax 202-481-1505.

There is also an email listed: disasterloans@sba.gov. Caution should be used as this is an unsecure link and has size limitations. If you prefer Snail mail the address is:

U.S. Small Business Administration

Processing & Disbursement Center

Attn: ELA Mail Department

P.O. Box 156119

Fort Worth, TX 76155

We have inquired about the contradictory instructions regarding submitting “Additional Forms”; Form 5, Filing Requirements instruct applicant to send Request for Transcript of Tax Return (form 4506T), Personal Financial statement (form 413D) and Schedule of Liabilities (form 2202) while the SBA Economic injury Disaster Loan Assistance page says that a Disaster Assistance loan officer may request them. At this point in time the recommendation is to go ahead and send in the Additional Forms along with form 5 and Form P-019. The more information received will assist in streamlining the process.

For frequently asked questions regarding the CARES Act, and information on how to apply, please download the following resource:

Our Summit team remains here to serve you and your family during this difficult time, and we are honored to partner together with you.

You must be logged in to leave a reply.